The Champagne region has long been synonymous with celebration, luxury, and refined taste. But in recent decades, it has also become a significant player in the fine wine investment market. [read the full champagne story]

Estimated reading time: 7 minutes

Among the many vintages released in the 21st century, one stands out as a true icon—the 2008 vintage. Hailed by critics, loved by collectors, and sought after by investors, the 2008 Champagne vintage is now firmly established as one of the greatest in modern times.

In this article, we’ll explore why the 2008 Champagne vintage is so exceptional, its investment potential, and the top houses to consider when building a portfolio.

1. Unmatched Quality: A Perfect Storm of Conditions

2008 was a remarkable year for the Champagne region. Despite a cool, cloudy summer, a sunny, dry September saved the harvest, allowing the grapes to ripen perfectly while retaining exceptional acidity.

Key attributes of the 2008 vintage:

• Bright acidity paired with impressive structure

• Low pH levels for long-term aging potential

• Perfect balance of freshness and depth

• High levels of natural phenolic ripeness

These conditions produced wines with elegant tension, purity of fruit, and exceptional aging potential, making them ideal candidates for both consumption and investment.

2. Critical Acclaim Across the Board

The 2008 vintage has been almost universally praised by critics, sommeliers, and winemakers alike.

• Richard Juhlin, the world’s foremost Champagne authority, calls it “one of the most classic and best vintages of all time.”

• Antonio Galloni (Vinous) praised the wines for their “energy and precision.”

• Jancis Robinson and other critics have repeatedly highlighted its aging potential and refinement.

With such high praise, the 2008 vintage has garnered strong demand from collectors around the world.

3. Long-Term Aging Potential = Long-Term Value

Champagnes from 2008 have the kind of structure and acidity that allow them to evolve for decades. Unlike earlier vintages like 2002 or 1996, which are now beginning to show signs of maturity, 2008s are still in their prime or even just entering it, depending on disgorgement dates.

• Many top houses released their 2008s later than usual (some not until 2019–2021), giving investors more time to capitalize on their relative youth.

• The long drinking window creates more opportunities for collectors to trade or sell at premium prices as the wines mature.

4. Limited Supply & High Demand

Unlike 2002 or 2012, the 2008 vintage had relatively moderate yields. Furthermore, many houses held back their 2008 prestige cuvées for late release, limiting early market exposure and building anticipation.

This scarcity has led to:

• Tight allocations for global markets

• Increased prices on release

• Secondary market premiums as collectors and drinkers snap up remaining bottles

As availability shrinks, values typically rise—making the 2008 vintage an attractive proposition for investors.

5. Prestige Cuvées from Legendary Houses

Many of the most prestigious Champagne producers released landmark 2008 bottlings that are now viewed as benchmarks. Among the most notable:

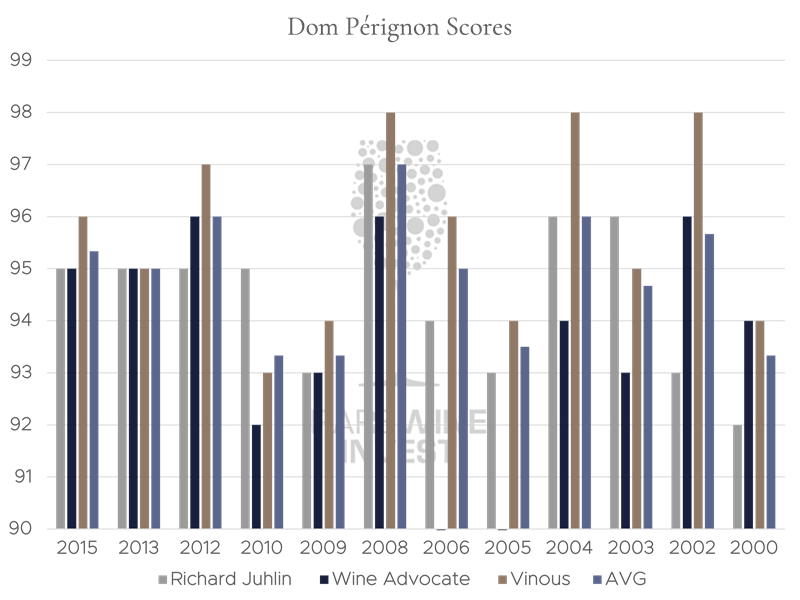

• Dom Pérignon 2008 – A cooler, tighter expression praised for its linear structure and energy. Often cited as one of the best DPs of all time.

• Louis Roederer Cristal 2008 – A masterclass in finesse and longevity, earning multiple 100-point scores.

• Pol Roger Sir Winston Churchill 2008 – Rich, powerful, and cellar-worthy, with impeccable balance.

• Bollinger La Grande Année 2008 – Classic Bollinger with muscle and complexity, built for aging.

• Krug 2008 – Released as “Krug 2008” (unlike most vintages labeled by Édition number), underlining its iconic status.

• Salon 2008 – Released as a unicorn vintage, limited in quantity and already a collector’s treasure.

These cuvées are already appreciating in value, especially those with limited production or late release schedules.

6. Market Performance & Investment Returns

Many 2008 Champagnes have shown strong market performance, with price appreciation exceeding those of neighboring vintages.

• Dom Pérignon 2008 appreciated by over 40% within 2 years of release.

• Cristal 2008 has nearly doubled in value since release, particularly in top vintages and formats (magnums, jeroboams).

• Salon 2008—extremely limited and in high demand—has already reached 5x retail price on some secondary markets.

Investment in Champagne is also seen as less volatile compared to Bordeaux or Burgundy, thanks to:

• Broader global demand (including casual luxury buyers)

• Strong branding from major houses

• Consistency in style and quality

7. Growing Interest in Champagne as an Asset Class

Historically underappreciated as an investment compared to red Bordeaux or Burgundy, Champagne has now emerged as a top-performing wine category.

According to the Liv-ex Fine Wine Index:

• Champagne outperformed both Bordeaux and Burgundy in recent years

• Vintage Champagne, especially 2008s, is seeing greater liquidity and visibility in the secondary market

• Champagne offers diversification for wine investors due to its unique style, consumer base, and price behavior

8. Perfect for Diversified Collectors and Enthusiasts Alike

Even beyond pure ROI, the 2008 vintage offers unmatched pleasure for wine lovers and collectors. Investing in 2008 Champagnes gives you access to:

• World-class wines for special occasions or vertical tastings

• Legacy cuvées that define the essence of prestige

• Bottles that can be cellared or traded based on market conditions

Whether you’re a seasoned collector or a newcomer to wine investment, the 2008 Champagne vintage offers a rare combination of quality, scarcity, and upside potential.

Final Thoughts: A Vintage That Has It All

The 2008 vintage in Champagne has already entered the pantheon of greats. With perfect growing conditions, glowing critical acclaim, exceptional aging potential, and increasing scarcity, it represents one of the best opportunities in fine wine investment today.

In a market where timing and quality are everything, 2008 offers both. Whether you’re investing for passion, profit, or prestige—this is the vintage to own.

Suggested Starting Points for Investment:

• Dom Pérignon 2008

• Cristal 2008

• Krug 2008

• Pol Roger Sir Winston Churchill 2008

• Salon 2008 (if you can find it)

• Bollinger La Grande Année 2008

• Pierre Péters Les Chétillons 2008 (grower Champagne with cult following)

Top-10 lots in the Bukowski auction in Stockholm – april’25

There are 53 lots of 2008 Champagnes shown in the upcoming action;

2008 Pierre Péters Cuvée Spéciale Les Chétillons

2008 Comtes de Champagne, Taittinger

2008 Piper-Heidsieck Brut Cuvée Rare

2008 Cuvée Sir Winston Churchill